fly-project-la-musica.ru Tools

Tools

Health Insurance For Contractors

Blue Cross Blue Shield is the best health insurance company for the self-employed. We evaluated quality ratings, pricing, and more to help you choose the. Contractors Health Trust provides health benefit plans for employer members of the Colorado Contractors Association, the Associated General Contractors of. Explore Anthem individual and family plans for self-employed workers and find coverage that works for your unique healthcare needs and budget. There are various options available, including private health insurance plans, health savings accounts (HSAs), and flexible spending accounts (FSAs). If the. If you have a small business ( employees), you're not required to offer your employees health insurance. If you do, you might qualify for tax credits. Bronze plans are high-deductible health plans (HDHP) with low premiums. Platinum plans have the highest monthly premium but pay the most for medical care. (Very. Generally, if you run your own business and have no employees, or are self-employed, your business won't qualify for group coverage. Most benefit experts advise against including independent contractors or other non-employees such as employees, non-employee directors, or leased. With a large network of providers and easy tools and resources, those who are self-employed can quickly find a health insurance plan that works for them. Blue Cross Blue Shield is the best health insurance company for the self-employed. We evaluated quality ratings, pricing, and more to help you choose the. Contractors Health Trust provides health benefit plans for employer members of the Colorado Contractors Association, the Associated General Contractors of. Explore Anthem individual and family plans for self-employed workers and find coverage that works for your unique healthcare needs and budget. There are various options available, including private health insurance plans, health savings accounts (HSAs), and flexible spending accounts (FSAs). If the. If you have a small business ( employees), you're not required to offer your employees health insurance. If you do, you might qualify for tax credits. Bronze plans are high-deductible health plans (HDHP) with low premiums. Platinum plans have the highest monthly premium but pay the most for medical care. (Very. Generally, if you run your own business and have no employees, or are self-employed, your business won't qualify for group coverage. Most benefit experts advise against including independent contractors or other non-employees such as employees, non-employee directors, or leased. With a large network of providers and easy tools and resources, those who are self-employed can quickly find a health insurance plan that works for them.

If you're self-employed or starting a solo business with little income: You'll probably qualify for low-cost insurance or free or low-cost coverage through. Group Insurance for Employees & Contractors. Group benefits are far less expensive than individual health insurance. The coverage is generally better, and. If your employer does not offer health insurance, or if the insurance offered does not meet your needs, you may want to purchase an individual policy. Depending. Workers' compensation insurance is required for all employers operating in Colorado, with a few limited exceptions listed on our Independent Contractors and. The short answer is yes, it is possible to offer health insurance to independent contractors. However, there are some nuances, regulations, and potential. This standard form meets the data-collection needs of health plans, hospitals and other healthcare organizations.” • Collect and keep on file copies of all. Freelancer Health Insurance FAQs · $ — average monthly premium for individual plans · $ — average premium for individuals aged 35 to 44 · $ — average. Freelancers, independent contractors and other people who don't have health insurance shoppers to get the coverage and care that's right for them. We offer health insurance for entrepreneurs, small business owners, and contractors that offer affordable monthly payments, low deductibles, and. Click below to see our Health Insurance guide for a basic overview of our offerings. © Independent Contractors Benefits Association, Inc., All Rights. Find quality health insurance for self-employed individuals. Discover how to choose the right health insurance plan by factoring cost savings and benefits. Self-employed workers can get private health insurance or federal marketplace coverage, also known as the Affordable Care Act (ACA) or Obamacare health. fly-project-la-musica.ru is excited to announce an opportunity for our independent contractors to access insurance through Physician Solutions, LP. ACA exchange · Short-term health insurance policies · Medicaid · COBRA coverage · Associations · Parent, spouse, or domestic partner's health plan. Below we explain different health insurance options available to self employed professionals along with their pros and cons. You can apply for individual and family health insurance coverage through MNsure if you are a freelancer, consultant, independent contractor. What is an Health Maintenance Organization (HMO)? What is a Preferred Provider Organization (PPO)? What is an Indemnity Policy? What is Aflac? We give your contractors the option to opt into a healthcare benefits plan that will provide them with a sense of security and top-class coverage. fly-project-la-musica.ru is excited to announce an opportunity for our independent contractors to access insurance through Physician Solutions, LP. health insurance at the earliest enrollment date of your employer's health care contractor. Back to top. When does my health care coverage begin? Coverage.

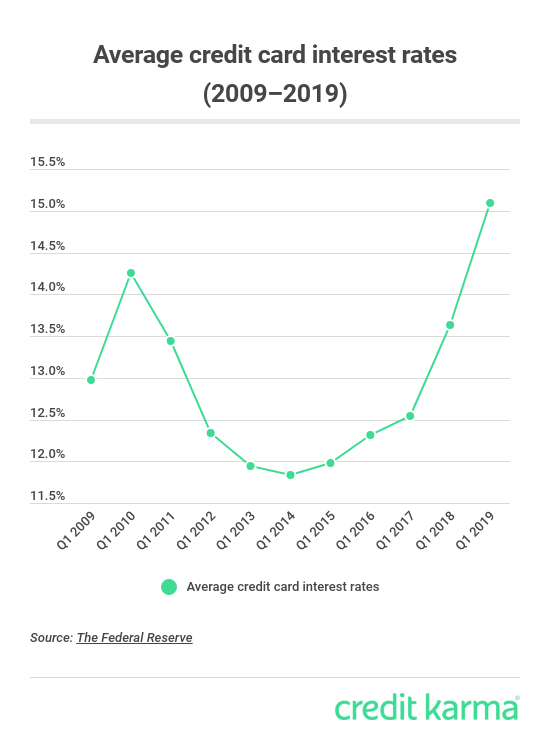

Average Apr With Good Credit

However, an average interest rate on a car loan for people with bad credit has been %. What Is a Good Interest Rate on a Car Loan? 3. Calculate. Lookup my Credit Score. Low APR. Average APR. High APR. Disclosure: About these results. Auto Loan Payment Calculator. A good APR for a credit card is around 17% or below. A credit card APR in this range is on par with the interest rates charged by credit cards for people with. *% Annual Percentage Rate (APR) is an introductory rate for the first six months. After the introductory period, rate on the outstanding balances will. To determine if an APR is good or not, look at the average rates for people with the same credit score as you. For someone with a good or very good credit score. High Credit Score → Low Interest Rate. Average Credit Score → Medium Interest Rate. Low Credit Score → High Interest Rate. Other Factors Affecting Your Auto. The average APR for all cards in the U.S. News database is % to %. Type of rewards card, Average minimum APR, Average maximum APR. Travel. Typically, a credit score below is going to give you a higher interest rate. You could pay 16% or more. Having a credit score between and tends to. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. However, an average interest rate on a car loan for people with bad credit has been %. What Is a Good Interest Rate on a Car Loan? 3. Calculate. Lookup my Credit Score. Low APR. Average APR. High APR. Disclosure: About these results. Auto Loan Payment Calculator. A good APR for a credit card is around 17% or below. A credit card APR in this range is on par with the interest rates charged by credit cards for people with. *% Annual Percentage Rate (APR) is an introductory rate for the first six months. After the introductory period, rate on the outstanding balances will. To determine if an APR is good or not, look at the average rates for people with the same credit score as you. For someone with a good or very good credit score. High Credit Score → Low Interest Rate. Average Credit Score → Medium Interest Rate. Low Credit Score → High Interest Rate. Other Factors Affecting Your Auto. The average APR for all cards in the U.S. News database is % to %. Type of rewards card, Average minimum APR, Average maximum APR. Travel. Typically, a credit score below is going to give you a higher interest rate. You could pay 16% or more. Having a credit score between and tends to. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed.

Typically, the higher your credit score, the lower your interest rate will be. That's because a high credit score indicates that you have a good history of. A good APR is anything under 22% – which is the average APR for credit cards in America. For an excellent APR, aim for 18% or less. This is considered an. Average Auto Loan Rates for Excellent Credit: to ; Risk category, Credit score, Average new car loan rate ; Super prime, –, %. good interest rate credit score, one that can help you save money with lower interest rates. It. Average is currently %. % is only eligible for people with excellent credit. Either way, it makes buying any car unaffordable for now if that is the. With excellent credit and an average APR of 5%, the monthly payment would be $ While with good credit and an average APR of 10%, the monthly payment would. Average Personal Loan Interest Rates By Credit Score ; Excellent credit ( to ). % ; Good (), % ; Fair (), % ; Bad (). The average interest rate on a new car loan with a credit score of is %, while the average interest rate on a used car loan is %. What kind of. The average new car APR for someone with a credit score is % (according to Experian). A score, on the other hand, averages at %. Loan amount. What is the average APR on a credit card? The Federal Reserve regularly Your CreditWise score can be a good measure of your overall credit health. At my credit union, new car rates are around % for excellent credit. But for older models, the interest rate is higher. Reply reply. Award. The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card. Average Interest Rates for Car Loans with Bad Credit ; Prime (), %, % ; Nonprime (), %, % ; Subprime (), %, % ; Deep. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. The average interest rate on good credit auto loans is around % for new car purchases and % for used car purchases, but lower rates do exist. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %. Advertised as low as APRs (Annual Percentage Rate) assume excellent borrower credit history. This interest rate discount is not reflected in all our published. These are the average auto loan rates by state, as determined by Edmunds data. Click on a state to view the APR for different vehicle types. If you have excellent credit ( or higher), the average auto loan rates are % for a new car and % for a used car. APR [?], Monthly payment *. Location. National Avg Many factors affect your FICO Scores and the interest rates you may receive. Fair Isaac is not a credit.

Mortgage Loan Companies For Poor Credit

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)

FHA loans are still a much better idea than subprime loans from possibly sketchy lenders. Subprime or Non-QM loans (as they have come to be called today). Compared to other options, alternative lenders are most likely to give more accommodating options. An example of an alternative lender is Alpine Credits, and. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Good for loans under $5, Depending on where you live, you can borrow as little as $ and up to $5, from Rise. This is good news if you have a smaller. If you currently own a residential property or you would like to purchase a residential property we may be able to secure mortgage financing for you. Please. Our extensive network of lenders enables us to find the most competitive interest rates for your bad credit mortgage loan. We work hard to ensure that you get. Best Mortgage Lenders for Bad Credit for · Best Overall: American Pacific Mortgage · Best for First-Time Homebuyers, Best for Fast Closing: Rate · Best for. Our lender network includes a roster of high-risk mortgage lending companies and individuals that offer loans to bad credit and low-income borrowers. Bad Credit FHA Mortgage Loans are mortgage options that allow you to buy a home or refinance your current mortgage with less than perfect credit. We can finance. FHA loans are still a much better idea than subprime loans from possibly sketchy lenders. Subprime or Non-QM loans (as they have come to be called today). Compared to other options, alternative lenders are most likely to give more accommodating options. An example of an alternative lender is Alpine Credits, and. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Good for loans under $5, Depending on where you live, you can borrow as little as $ and up to $5, from Rise. This is good news if you have a smaller. If you currently own a residential property or you would like to purchase a residential property we may be able to secure mortgage financing for you. Please. Our extensive network of lenders enables us to find the most competitive interest rates for your bad credit mortgage loan. We work hard to ensure that you get. Best Mortgage Lenders for Bad Credit for · Best Overall: American Pacific Mortgage · Best for First-Time Homebuyers, Best for Fast Closing: Rate · Best for. Our lender network includes a roster of high-risk mortgage lending companies and individuals that offer loans to bad credit and low-income borrowers. Bad Credit FHA Mortgage Loans are mortgage options that allow you to buy a home or refinance your current mortgage with less than perfect credit. We can finance.

Learn about available bad credit home loans. Getting a home loan with bad credit is possible through conventional and government-backed programs. A bad credit mortgage is an alternative financing solution to a traditional bank mortgage. Even if you've already spoken with a mortgage specialist and still. Our bad credit mortgages help you get a mortgage with a bad credit history. You can choose from changing-rate mortgages, steady-rate mortgages, and private. If your credit score is below , you will need to go through either a Subprime Lender or Private Lender. A mortgage broker can look at your financial. It might be difficult to qualify for a conventional loan if you have poor credit. Fannie Mae and Freddie Mac both require a minimum credit score of at least We offer a variety of bad credit home loans for consumers with less than perfect credit or low credit scores. For over 30 years Churchill Mortgage has been on a mission to lead our clients to the ultimate American dream — debt-free homeownership. We believe debt-free. We've made a list of mortgage lenders for poor credit, who deal with applicants who have a low credit score. The bad credit mortgage is often called a sub-prime mortgage and is offered to homebuyers with low credit ratings. No neeed for a perfect credit score to qualify for an affordable home loan. Call us at () We will work with you until we have found a solution. FHA Loan FHA loans are government-insured, offering low down payments and easier qualification for those with low credit. Refinance Refinancing replaces your. Many companies will not lend to borrowers with scores below a or a Though, low scores alone shouldn't disqualify you from a home loan. It may. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. Artisan Mortgage offers Bad Credit Home Mortgage Loans in New York & Pennsylvania and subprime mortgages to people with low + FICO scores in Long Island. 10 best mortgage lenders for borrowers with bad credit scores · Mr. Cooper mortgage · 9. Rocket mortgage · 8. eMortgage · 7. Carrington mortgage · 6. CITI. Utah Bad Credit Mortgage Loan · If your credit is much lower than average, getting someone to cosign with you could make the difference in whether you could be. On the other hand, you can qualify for an FHA loan if your credit score is above So if your credit score is lower, your best bet may be applying for an FHA. Our Second Chance Home Loan Program provides home buyers with damaged credit the opportunity to purchase a home. In recent years, borrowers that did not have. Many Canadian lenders, some of which are highlighted on our list, are ready to extend financial support to individuals with credit scores even below Get the funds you need fast by exploring the best bad credit loans from top lenders like Discover, Upstart, & SoFi. Find your lowest rate & apply online!

Blockchain Clinical Trials

The initial launch of the Blockchain for Clinical Trials initiative was a great success. The Forum, which occurred on 12 February in Orlando, FL welcomed. Harry Salivaras: If Blockchain Based, Future Clinical Trials Will Grant Data Privacy and Freedom Harry E. Salivaras is a young researcher, studying. Blockchain is a tiny portion of the software and functionality of an eClinical software product, but it might prove useful. The question I would. Triall offers the technology, tools, and expertise to drive your clinical development forward. We empower clinical research professionals throughout the full. To evaluate, educate and embrace viable applications of blockchain technology within the pharmaceutical framework that will lead to enhanced patient care. Blockchain technology can be used to augment the entire workflow of clinical trials and overcome the mentioned challenges. It uses consensus protocol for. It could also streamline the communication between doctors and patients during the trial. Blockchain has the tools to provide smart contracts that endorse. Additional issues include data volume, data quality issues, assessment of data anomalies in real time, and out-of-date study metrics. Blockchain technology for. Blockchain allows for reaching a substantial level of historicity and inviolability of data for the whole document flow in a clinical trial. Hence, it ensures. The initial launch of the Blockchain for Clinical Trials initiative was a great success. The Forum, which occurred on 12 February in Orlando, FL welcomed. Harry Salivaras: If Blockchain Based, Future Clinical Trials Will Grant Data Privacy and Freedom Harry E. Salivaras is a young researcher, studying. Blockchain is a tiny portion of the software and functionality of an eClinical software product, but it might prove useful. The question I would. Triall offers the technology, tools, and expertise to drive your clinical development forward. We empower clinical research professionals throughout the full. To evaluate, educate and embrace viable applications of blockchain technology within the pharmaceutical framework that will lead to enhanced patient care. Blockchain technology can be used to augment the entire workflow of clinical trials and overcome the mentioned challenges. It uses consensus protocol for. It could also streamline the communication between doctors and patients during the trial. Blockchain has the tools to provide smart contracts that endorse. Additional issues include data volume, data quality issues, assessment of data anomalies in real time, and out-of-date study metrics. Blockchain technology for. Blockchain allows for reaching a substantial level of historicity and inviolability of data for the whole document flow in a clinical trial. Hence, it ensures.

Blockchain technology is not just a buzzword. Its core properties - decentralization, immutability, and transparency make it an ideal solution. We propose a blockchain-based system to make data collected in the clinical trial process immutable, traceable, and potentially more trustworthy. We use raw. Blockchain technology could help reshape how the health care industry stores, tracks and shares patient data and medical information. Disrupting Clinical Data Management & Transparency. The blockchain technology has the potential to disrupt clinical data management and transparency processes. The Blockchain for Clinical Trials Initiative · A patient-data driven blockchain empowering patients to “manage” their health record · Closing the disconnect. Blockchain is a tiny portion of the software and functionality of an eClinical software product, but it might prove useful. The question I would. Healing information silos with blockchain · Tracing prescription medicines and vaccines · Protecting pharmaceutical product integrity · Making clinical trials. Innovative technologies like blockchain in clinical trials could pave the way for more efficient, secure, and patient-centric clinical trials. research to R&D to clinical trials to manufacturing to patient. During the Inaugural Blockchain in Pharma, R&D, and Healthcare conference, early adopters. Although several research studies show that blockchain solutions help to improve patient retention, data integrity, privacy, and ensure CTs compliance with. BlockTrial, a system that uses a Web-based interface to allow users to run trials-related Smart Contracts on an Ethereum network, could be used to increase. Blockchain allows for reaching a substantial level of historicity and inviolability of data for the whole document flow in a clinical trial. Hence, it ensures. Blockchain in Clinical Research Recording. During clinical trials, human biological samples are collected at clinical investigator sites over an extended period. Providing transparency in today's complex clinical data demands cutting-edge technology. Blockchain technology provides data integrity and security by providing. Providing transparency in today's complex clinical data demands cutting-edge technology. Blockchain technology provides data integrity and security by providing. Applying Blockchain to clinical trials can improve multiple issues, such as patient retention, regulatory oversight, partner coordination, and fraud. PurposeThe authors propose a blockchain platform for managing clinical trial data to enhance data validity, integrity, trust and transparency in the. The blockchain technology is a safe and secure platform for storing and processing all types of valuable information, from clinical trial analysis results to. The advancement of blockchain technology and DLT frameworks of documentation management has the potential to improve the quality of clinical research. By. Blockchain and Clinical Trial: Securing Patient Data (Advanced Sciences and Technologies for Security Applications): Medicine & Health.

Home Loan Borrowing Calculator

Estimate your borrowing power. Our buying power calculator gives you an idea of the maximum you could spend on a property, in minutes. Get started. How much will my mortgage repayments be? How much can I borrow? How can I repay my home loan sooner? Average interest rate. Choose your loan and repayment. Estimate your borrowing capacity with Commbank's borrowing power calculator. Make informed home buying decisions and plan your finances better! Automating repayments, consolidating debt and taking steps to improve overall credit health is a key first step to possibly enhance the terms of your mortgage. Effortlessly manage your budget with Commbank's mortgage repayment calculator. Quickly estimate your home loan repayments using this easy-to-use tool. One of the key factors that determine your borrowing power is your credit score. A high credit score indicates good creditworthiness and can increase your. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Compare home buying options. Unsure how much you can borrow for a mortgage? Use our affordability calculator to estimate how much you could afford & what the repayments could be. This calculator helps you work out the most you could borrow from the bank to buy your new home. This is called your borrowing power. Estimate your borrowing power. Our buying power calculator gives you an idea of the maximum you could spend on a property, in minutes. Get started. How much will my mortgage repayments be? How much can I borrow? How can I repay my home loan sooner? Average interest rate. Choose your loan and repayment. Estimate your borrowing capacity with Commbank's borrowing power calculator. Make informed home buying decisions and plan your finances better! Automating repayments, consolidating debt and taking steps to improve overall credit health is a key first step to possibly enhance the terms of your mortgage. Effortlessly manage your budget with Commbank's mortgage repayment calculator. Quickly estimate your home loan repayments using this easy-to-use tool. One of the key factors that determine your borrowing power is your credit score. A high credit score indicates good creditworthiness and can increase your. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Compare home buying options. Unsure how much you can borrow for a mortgage? Use our affordability calculator to estimate how much you could afford & what the repayments could be. This calculator helps you work out the most you could borrow from the bank to buy your new home. This is called your borrowing power.

Borrowing power results slider. fly-project-la-musica.ru Home Loans logo · Contact usOur loansAbout us. fly-project-la-musica.ru is owned and operated by ASX-listed REA Group. The ING Borrowing Power Indication is not an offer of credit. If you wish to apply for a loan please call us on Any application for credit is. Your borrowing capacity is generally calculated as your net income (income after tax) minus your expenses. These expenses may include normal household costs. How much can I borrow? Check out approximately how much you will be eligible to borrow with our borrowing power calculator taking into account your income. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use our mortgage calculators and other tools to estimate the cost of your home. Calculate monthly payments and what you may be able to borrow with Wells. Use our home loan borrowing power calculator to find out how much you can borrow, simply enter your income and expenses to estimate your home loan borrowing. Get a quick quote for how much you could borrow for a property you'll live in, based on your financial situation. Lenders will likely lend you no more than 80% of your home's current value. To calculate your home's usable equity, take 80% of the value of your property minus. ANZ Home Loans are subject to our lending criteria, terms, conditions and fees. This calculator is for information purposes only and does not provide financial. Use this calculator to help estimate how much of a home loan you can afford based on your income and current debt. Use our borrowing power calculator to get a quick estimate on how much you may be able to borrow based on your current income and existing financial. Use our home borrowing calculator to estimate what loans you might qualify for. Our home borrowing calculator factors in wages, investments, expenses and. Borrowing power is a term that lenders sometimes use to describe the loan amount you could borrow when applying for a personal loan or home loan. In some ways. Free loan calculator to find the repayment plan, interest cost, and home / financial / loan calculator. Loan Calculator. A loan is a contract. Use this mortgage qualification calculator to determine your maximum mortgage loan amount, as well as other important details about your home purchase. Now that you have your estimated home price, check out different loan options with our Mortgage Calculator. borrow but how much you should borrow. Borrowing power calculator - How much can I borrow? This calculator estimates your borrowing power based on your income, financial commitments and loan details. home loan. This borrowing calculator does not provide financial advice, and is not a quote or an offer of finance by BNZ. This borrowing calculator does not. Borrowing power refers to the amount that a lender, like a bank, is likely to lend you when you take out a loan. When you're looking to buy a house, knowing.

How To Get Money Right This Second

Highlights: You'll be a self-published author, and if everything goes right, theoretically you could make some good money. cash or another gift card. Jim will only be able to take a second loan if your plan's terms allow it. You'll find how to determine the maximum amount Jim may borrow in IRC Section 72(p)(2. Looking for i need money right this second? Fundo offers easy Loans Online with same day approval. Funding in 60* secs once approved. Second Draw PPP loan. Read about Second Draw PPP loans. Get help with your PPP loan Get help with a PPP loan. Short URL: fly-project-la-musica.ru Return to top. Footer. Right to Buy Mortgages · Help to Buy Mortgages Log into the application portal to get started, or register if it's your first case with Pepper Money. From your joint account to another joint account you have with a different person Losing money through right of set-off is a warning sign. Take two. While it might sound strange, these market research surveys are a known way to make extra cash online. Of course, they won't make you rich but if you have. There are a number of ways to make extra money on the side without having to get a second job. · You could also look into ways to make money from. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. Highlights: You'll be a self-published author, and if everything goes right, theoretically you could make some good money. cash or another gift card. Jim will only be able to take a second loan if your plan's terms allow it. You'll find how to determine the maximum amount Jim may borrow in IRC Section 72(p)(2. Looking for i need money right this second? Fundo offers easy Loans Online with same day approval. Funding in 60* secs once approved. Second Draw PPP loan. Read about Second Draw PPP loans. Get help with your PPP loan Get help with a PPP loan. Short URL: fly-project-la-musica.ru Return to top. Footer. Right to Buy Mortgages · Help to Buy Mortgages Log into the application portal to get started, or register if it's your first case with Pepper Money. From your joint account to another joint account you have with a different person Losing money through right of set-off is a warning sign. Take two. While it might sound strange, these market research surveys are a known way to make extra cash online. Of course, they won't make you rich but if you have. There are a number of ways to make extra money on the side without having to get a second job. · You could also look into ways to make money from. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday.

Consumers often have an existing relationship with a bank, making it somewhat easier to apply. Cons. Banks may resell your loan to another institution. Fees can. Getting another personal loan will give you access to the money you need right away, but there are downsides. You should only get another personal loan if. getting cash back at closing. Interest rates as low A VA Cash-out refinance loan may be right for those who want to trade their home's equity for cash. Refer your friends & family to SoFi and get paid. Member Advisory Board. Meet SoFi reserves the right to change interest rates at any time without. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. It's important to make sure the recipient's information is correct because sending money to the wrong recipient could result in a loss of funds. Tap Send. Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! - Still got issues with the. Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! - Still got issues with the. Generally, a bank must make the first $ from the deposit available—for either cash The rest of the deposit should generally be available on the second. Research the consignment shops in your area to find the right match for the types and styles of clothing you have to sell. Most consignment stores will price. Another approach to securing money quickly is by generating immediate income through side hustles, especially when you need money desperately. Engaging in pet. -If you have strong knowledge of Social Media. Find companies who does not have a strong social media/web presence and help build a social media presence. You. The type of aid you accepted affects when you'll get your aid. Grants and Student Loans. Generally, your school will give you your grant or loan money in at. A budget is a roadmap to plan your finances and keep track of where your money goes. Budgeting is a helpful tool whether you're working hard to make ends meet. Earn cash through Facebook Marketplace or turn game playing into a lucrative avenue. Online surveys and focus groups offer a chance to make extra cash. Even. be pressured into borrowing more from them to repay one debt with another. If you've borrowed from a loan shark. If you have borrowed money from a loan shark. A: We hold your check until your next scheduled payday. Q: If I currently have a cash advance through another provider, can I get another cash advance here? A. Extra cash from a refund, bonus or other source should be put toward high-interest debt first, such as credit card debt. · Yes, you can treat yourself, but a. second street guaynabo, PR () [email protected] money you have invested but also on any growth of that money's earnings. “As.

Dish Network Technical

Find DISH Network customer service contact info and phone numbers for existing customers OR for New DISH customers call () to order today! DISH Network Technologies India Pvt. Ltd is a technology division of DISH Network Corporation (NASDAQ: DISH), a Fortune company that's been at the. Find the help you need from DISH support with hundreds of articles and step-by-step videos about how to manage your service. The highest quality products and services combined with top-notch customer service means High Power is your best choice for DISH home installation. Call today for DISH Satellite TV service in Green Valley, AZ! Shop DISH packages for TV & Internet, and find great deals near you! Call today for DISH Satellite TV service in Ohio! Shop DISH packages for TV & Internet, and find great deals near you! Don't see your antenna listed here? Contact our Sales or Technical Support Team to make sure it works with DISH. and follow the prompts. DISH Technical Support information TDS can bundle your TDS and DISH bills, but we do not provide support for DISH products or the service itself; we leave. What do you need help with? Get help troubleshooting issues with your DISH service or equipment. Find DISH Network customer service contact info and phone numbers for existing customers OR for New DISH customers call () to order today! DISH Network Technologies India Pvt. Ltd is a technology division of DISH Network Corporation (NASDAQ: DISH), a Fortune company that's been at the. Find the help you need from DISH support with hundreds of articles and step-by-step videos about how to manage your service. The highest quality products and services combined with top-notch customer service means High Power is your best choice for DISH home installation. Call today for DISH Satellite TV service in Green Valley, AZ! Shop DISH packages for TV & Internet, and find great deals near you! Call today for DISH Satellite TV service in Ohio! Shop DISH packages for TV & Internet, and find great deals near you! Don't see your antenna listed here? Contact our Sales or Technical Support Team to make sure it works with DISH. and follow the prompts. DISH Technical Support information TDS can bundle your TDS and DISH bills, but we do not provide support for DISH products or the service itself; we leave. What do you need help with? Get help troubleshooting issues with your DISH service or equipment.

Call today for DISH Satellite TV service in Los Angeles, CA! Shop DISH packages for TV & Internet, and find great deals near you! Internet + Wireless · Internet + Phone. Smart technology. Back; Shop smart technology; Home office · Smart watches & devices · Smart home · In-car Wi-Fi. We call and talk to DISH Customer Service for you, or wait on hold and get a live rep for you- for free. If you want to do the dialing, waiting, and talking. We have listed the best ways to contact DISH below. () Customer service phone numbers There are a variety of ways to get in touch with DISH. Call DISH customer service agents can help you move service to a new address, upgrade your plan, resolve a technical issue, or understand your. DISH, an EchoStar Company, has been reimagining the future of connectivity for more than 40 years. Our business reach spans satellite television service, live-. Connect with High-Speed Internet and DISH TV Internet from $/mo. DISH partners with satellite, fiber, cable DSL and wireless providers to save you a. Call today for DISH Satellite TV service in Alabama! Shop DISH packages for TV & Internet, and find great deals near you! Over the phone at (for new customers) and (for existing customers) Chat online at My DISH Support Email DISH at Care@dish. If you have additional questions, please feel free to email us at [email protected] Activate Now · Training Videos fly-project-la-musica.ru; Find. For technical assistance or troubleshooting, call Dish Network's technical support line: () What is Dish Network's email address? To send an. Call today for DISH Satellite TV service in California! Shop DISH packages for TV & Internet, and find great deals near you! If you have checked all of your antenna settings and still need help, contact your antenna manufacturer or our Dish Outdoors Technical Support Team. Fiber Internet · CenturyLink · Earthlink · Frontier Communications · Cox Communications · Windstream. Call today for DISH Satellite TV service in Georgia! Shop DISH packages for TV & Internet, and find great deals near you! To receive outage credits, you must contact DISH customer service by phone or chat within 72 hours of the outage. Upon verifying the outage, DISH will issue. Assist customers with Dish systems and services, troubleshooting receivers and other hardware devices, right-sizing packages, explaining installation setup, and. Current customers can contact DISH Network customer service by calling If looking for new service please call Call today for DISH Satellite TV service in Michigan! Shop DISH packages for TV & Internet, and find great deals near you! Experiencing some technical difficulties? Searching for satellite signal. Make sure that you have a clear view of the sky. Obstructions such as trees can cause.

What Is An Ldi

:max_bytes(150000):strip_icc()/ldi.asp-final-0a7e5f3b91e14fafa1f40dda4c233f0d.png)

Liability Driven Investing (LDI) defines and identifies solutions aimed to reduce risks relative to pension liabilities, and this focus has led it to be. Our LDI Team offers insights for the coming year, addressing some commonly asked questions on funded ratios, intermediate credit, alternatives, cash-balance. Our LDI platform provides defined benefit plan sponsors with the power and flexibility of one of the most comprehensive fixed income businesses in the world. A custom LDI benchmark eliminates that second step, aligning tracking error with plan liabilities rather than a market benchmark. □. □. Gives fixed income. Liability-driven investing (LDI) can be an effective strategy for de-risking your funded status and adding stability to financial statements. In fact, in a. Our LDI strategy takes a plan-centric, solutions-driven, holistic approach to manage the volatility of a defined benefit plan's funded status and other key. Our liability-driven investment platform offers defined benefit pension funds the power and flexibility of one of the most comprehensive fixed income businesses. CDI and LDI strategies are deeply linked – any changes to the CDI portfolio over time will have knock-on effects on the hedging requirements for the LDI. The liability-driven investment strategy (LDI) is an investment strategy of a company or individual based on the cash flows needed to fund future liabilities. Liability Driven Investing (LDI) defines and identifies solutions aimed to reduce risks relative to pension liabilities, and this focus has led it to be. Our LDI Team offers insights for the coming year, addressing some commonly asked questions on funded ratios, intermediate credit, alternatives, cash-balance. Our LDI platform provides defined benefit plan sponsors with the power and flexibility of one of the most comprehensive fixed income businesses in the world. A custom LDI benchmark eliminates that second step, aligning tracking error with plan liabilities rather than a market benchmark. □. □. Gives fixed income. Liability-driven investing (LDI) can be an effective strategy for de-risking your funded status and adding stability to financial statements. In fact, in a. Our LDI strategy takes a plan-centric, solutions-driven, holistic approach to manage the volatility of a defined benefit plan's funded status and other key. Our liability-driven investment platform offers defined benefit pension funds the power and flexibility of one of the most comprehensive fixed income businesses. CDI and LDI strategies are deeply linked – any changes to the CDI portfolio over time will have knock-on effects on the hedging requirements for the LDI. The liability-driven investment strategy (LDI) is an investment strategy of a company or individual based on the cash flows needed to fund future liabilities.

LDI is a governance and risk management framework which With $bn of LDI assets under management1, Insight offers a full range of LDI capabilities. Liability-Driven Investing (LDI) is an investment strategy primarily used by institutional investors, such as pension funds and insurance. We believe successful Liability-Driven Investing (LDI) portfolio management requires a comprehensive knowledge of actuarial sciences as well as a deep. LDI is a popular and core risk management tool for pension schemes and insurance companies. The market has evolved over the years with our capabilities. The aim of an LDI strategy is to make the scheme's assets move in line with the value of its liabilities as interest rates and inflation change. We say the. The Central Bank has introduced macroprudential measures to Irish-authorised GBP-denominated liability driven investment (LDI) funds. LDI consists in developing investment strategies based on risk adjusted return relative to liabilities. LDI is a risk management strategy that seeks to align the plan's assets with its liabilities. This means that the investment strategy is designed to generate. This video is either unavailable or not supported in this browser · Our Expertise · Leader in LDI Investing · LDI Manager of the Year, · Our Latest Insights. We offer a suite of solutions across the entire liability driven investing (LDI) spectrum to help clients solve a variety of pension challenges. In its broadest sense, LDI is an approach to investment in which all or part of the strategy is designed to match a scheme's liabilities. Within this context. Liability-driven investment (LDI) is a core investment strategy for many life insurers, pension schemes and asset managers. It is an approach to investment. Our LDI strategy consultants partner with you to design a program that targets your desired interest rate and credit hedge ratios. Our LDI strategy consultants partner with you to design a program that targets your desired interest rate and credit hedge ratios. LDI seeks to hedge this risk by constructing an asset portfolio that closely matches the risk profile of the plan's liability. This paper will examine some. Liability-Driven Investing (LDI) is an investment strategy primarily used by institutional investors, such as pension funds and insurance. LDI, like ALM, is a framework for considering the assets of a pension plan or insurance company in the context of liabilities. In contrast however, LDI is a. In the LDI Strategy, one holds corporate bonds and Treasuries that are aligned with the plan's liability risk characteristics (Allocation 1), while the other. When the liabilities are given and assets are managed, liability-driven investing (LDI), a common type of ALM strategy, may be used to ensure adequate.

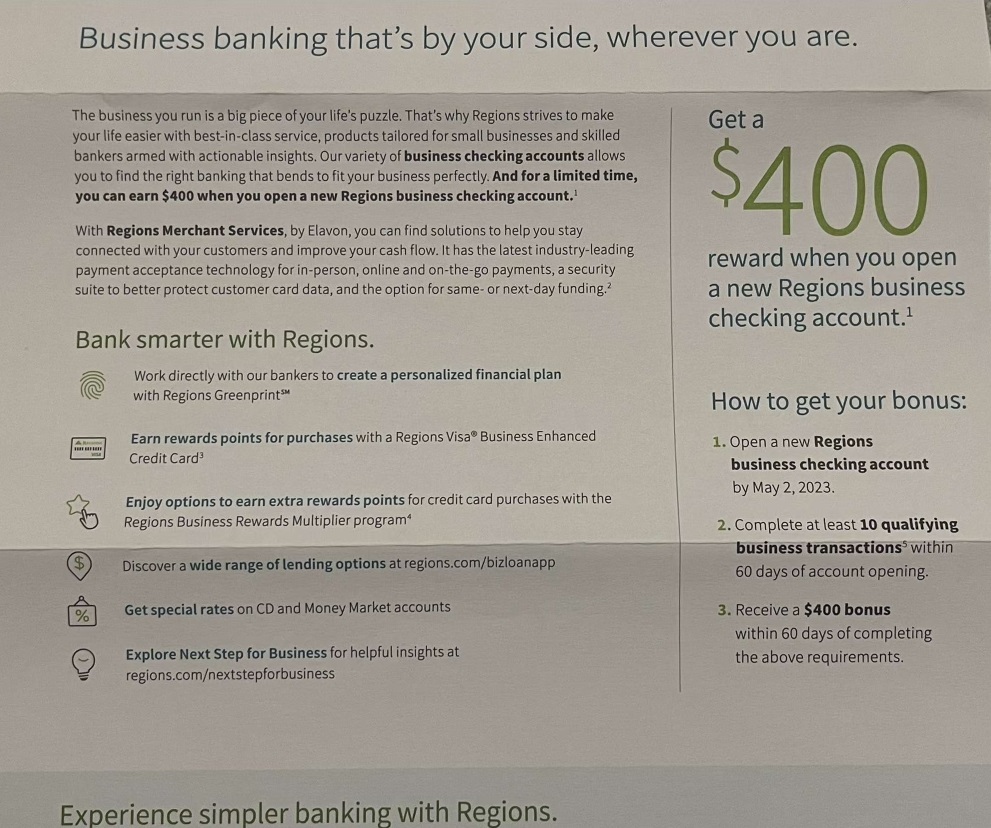

Regions New Account Bonus

You can earn up to $ per calendar year when your friends open a personal or business checking account with Regions and fulfills all requirements of the offer. How much does Regions Bank pay in bonuses? Regions Bank pays an average of $5, in annual employee bonuses. Bonus pay at Regions New research shows how to. LifeGreen Checking and Referral Bonus: Earn $ If you already bank with Regions, you can score a $50 Visa Reward card when you refer someone who opens a new. The annual savings bonus will be paid to your LifeGreen Savings account by the second business day of the month following your Account Anniversary Month. To. Set up monthly automated savings transfers from one of our checking accounts for an opportunity to earn an annual savings bonus of $ The Offer · Make $1, in total deposits that post to your account within 60 days of account opening. Deposits must be new to Regions · Enroll in online. The option to open a Regions LifeGreen® Savings account with no monthly fee and an opportunity to earn an annual savings bonus. 30% discount on one Safe. no overdraft Fees. Regions Now Checking® Checking account with safeguards to help manage your money and no overdraft fees. $5 monthly fee (can't be waived). Regions Bank is offering a $50 bonus when you open a new checking account. You must use a referral link to get this bonus. Credit Card Funding: Up to $ You can earn up to $ per calendar year when your friends open a personal or business checking account with Regions and fulfills all requirements of the offer. How much does Regions Bank pay in bonuses? Regions Bank pays an average of $5, in annual employee bonuses. Bonus pay at Regions New research shows how to. LifeGreen Checking and Referral Bonus: Earn $ If you already bank with Regions, you can score a $50 Visa Reward card when you refer someone who opens a new. The annual savings bonus will be paid to your LifeGreen Savings account by the second business day of the month following your Account Anniversary Month. To. Set up monthly automated savings transfers from one of our checking accounts for an opportunity to earn an annual savings bonus of $ The Offer · Make $1, in total deposits that post to your account within 60 days of account opening. Deposits must be new to Regions · Enroll in online. The option to open a Regions LifeGreen® Savings account with no monthly fee and an opportunity to earn an annual savings bonus. 30% discount on one Safe. no overdraft Fees. Regions Now Checking® Checking account with safeguards to help manage your money and no overdraft fees. $5 monthly fee (can't be waived). Regions Bank is offering a $50 bonus when you open a new checking account. You must use a referral link to get this bonus. Credit Card Funding: Up to $

$ bonus when opening any LifeGreen checking account by September 30, Availability: New checking customers in Alabama, Arkansas, Florida, Georgia. Grow savings. Earn a savings bonus Set up monthly automated savings transfers from a Regions checking account to a LifeGreen® Savings account for an. new qualifying Regions Online or Mobile Banking Bill Pay, Zelle® and account. Great job! Keep going until the end of the year to save nearly $7, Become a member at Purdue Federal Credit Union and earn a $ bonus by simply opening a new checking account with direct deposit and enrolling in paperless. Annual Savings Bonus – Earn an annual bonus of up to $ when you set up monthly automated transfers of at least $10 to your LifeGreen Savings account from. $0 monthly fee if you have a Regions checking account · No minimum balance requirement · Opportunity to earn an annual savings bonus up to $ if you set up. More student checking details · The option to open a Regions LifeGreen Savings account with no monthly fee and an opportunity to earn an annual savings bonus Get a $ cash bonus when you open a new Smart Money Checking or Smart Advantage Checking account and have a cumulative total of $4, in qualifying direct. Regions Bank is offering a $ bonus when you open a new checking account and meet certain requirements. U.S. Bank offers as much as $ in cash when you open a new checking account. Here's how to qualify for a U.S. Bank welcome bonus Select Region. US. Regions Now Savings Builder Bonus: Each month a deposit of funds of at least $5 is made to your Regions Now Savings account AND you make no withdrawals from. Savings account details · 1% annual savings bonus up to $ if you make a deposit of at least $5 to your account each calendar month, beginning with the account. Then, we'll deposit $ directly into your Regions checking account within days of completing these steps. I emailed [email protected] Benefits and features1% annual savings bonus up to $ if you set up month automated savings transfers from your Regions checking account. The Offer · Make $1, in total deposits that post to your account within 60 days of account opening. Deposits must be new to Regions · Enroll in online. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Earn $ bonus Cash Rewards when you spend $1, in the first 90 days, or earn a $ bonus when you spend $ in the first 90 days. checking or savings. Posting or soliciting referral links for those accounts will result in being banned from this sub. Please post new bank churning opportunities. Savings bonus — Earn an annual bonus of up to $ when you set up monthly automated transfers of at least $10 to your LifeGreen Savings account from your. Grow savings. Earn a savings bonus Set up monthly automated savings transfers from a Regions checking account to a LifeGreen® Savings account for an.

Car Wreck No Insurance

If you do not have auto insurance to cover accident victims, you may face a personal injury lawsuit. Accident victims have the right to hold you responsible for. The No Pay, No Play law does not interfere with passengers in a car accident where the driver did not have insurance. Suppose a passenger in your vehicle. If there was no auto policy in the household, you should file a claim with the Motor Vehicle Accident Indemnification Corporation (MVAIC). Can I sue for ". The meaning of no-fault insurance is a lot like it sounds. It means that if you are the victim of a car accident, you are unable to sue the negligent driver at. If you have been in a rental car accident without insurance, it is always in your best interest to contact an experienced auto accident attorney to discuss. If you were the victim of the crash, not having insurance shouldn't affect your ability to claim damages against the at-fault driver. If you caused an accident but do not have liability insurance, you may be liable for the damages any victims suffered out of your own pocket. This could cost. If you drive your car without the required insurance, you could receive a fine of $ or more. If you are at fault in an automobile collision and you do not. The most important thing to do is stop and stay at the accident scene until you've taken proper action. There are consequences for driving without insurance. If you do not have auto insurance to cover accident victims, you may face a personal injury lawsuit. Accident victims have the right to hold you responsible for. The No Pay, No Play law does not interfere with passengers in a car accident where the driver did not have insurance. Suppose a passenger in your vehicle. If there was no auto policy in the household, you should file a claim with the Motor Vehicle Accident Indemnification Corporation (MVAIC). Can I sue for ". The meaning of no-fault insurance is a lot like it sounds. It means that if you are the victim of a car accident, you are unable to sue the negligent driver at. If you have been in a rental car accident without insurance, it is always in your best interest to contact an experienced auto accident attorney to discuss. If you were the victim of the crash, not having insurance shouldn't affect your ability to claim damages against the at-fault driver. If you caused an accident but do not have liability insurance, you may be liable for the damages any victims suffered out of your own pocket. This could cost. If you drive your car without the required insurance, you could receive a fine of $ or more. If you are at fault in an automobile collision and you do not. The most important thing to do is stop and stay at the accident scene until you've taken proper action. There are consequences for driving without insurance.

If you're involved in an accident without insurance, and it's your fault, you'll be personally liable for any damages. If you didn't pay the UMV fee, you could. What happens if the person at fault in an accident has no insurance? If the driver at fault in an accident in Indiana has no insurance, then the victim of the. Following an accident in Indiana without car insurance, you not only will face penalties for being uninsured, but you'll be responsible for any damages caused. Exchange Contact Information. According to Indiana law, it is the duty of a driver involved in an accident where there is damage to a vehicle (but no injury. Even if you live in a state where car insurance is optional, you are still responsible for any injuries or damage you caused. The other driver can also still. Penalties for Driving Without Insurance · $ fine · Three-month suspension of license and registration · Must carry an SR certificate for two years. What your Basic insurance covers. Medical costs. Enhanced Accident Benefits are available to anybody in B.C. who is injured in a motor vehicle crash, no. If the at-fault party does not have car insurance, you can file a compensation claim with your insurance company or file a lawsuit against the negligent. In that case, your insurance company will likely not provide coverage. Some insurance policies will also not cover any driver that is not named in the policy. I. What to Do Right After a Car Accident With an Uninsured Driver · Call the Police to Report the Accident · Take Pictures · Exchange Information · Tell Your Car. First, make sure that the police have issued a citation to the uninsured motorist for both the moving violation, and for driving without. The reasoning behind "No Pay, No Play" laws is that if you don't have the required auto insurance that could provide full compensation to another person, then. What happens if you have no insurance but the other driver was at fault? If you were in a car accident without insurance and are not at fault, contact an. In Pennsylvania, it is illegal to drive without vehicle liability insurance. The state's financial responsibility law is in place to ensure the victims of. No insurance company shall require the use of after-market parts unless the When your car is totaled, the insurance company is responsible for its ACV. So, in summary, driving without insurance in Indiana can lead to severe penalties like fines, suspension of driving privileges, and fees to reinstate your. What Happens If You Have a No-Fault Accident Without Insurance? Sometimes accidents occur without fault from either party. For example, poor weather could. Automobile accidents: "No Fault" insurance. Automobile accidents: Time For more information about what to do if you are in an automobile accident, visit. The No Pay, No Play law does not interfere with passengers in a car accident where the driver did not have insurance. Suppose a passenger in your vehicle. When the other party doesn't have insurance, and you're not at fault for the accident, you can still bring a claim against the at-fault driver. You begin by.