fly-project-la-musica.ru News

News

Business Financial Information

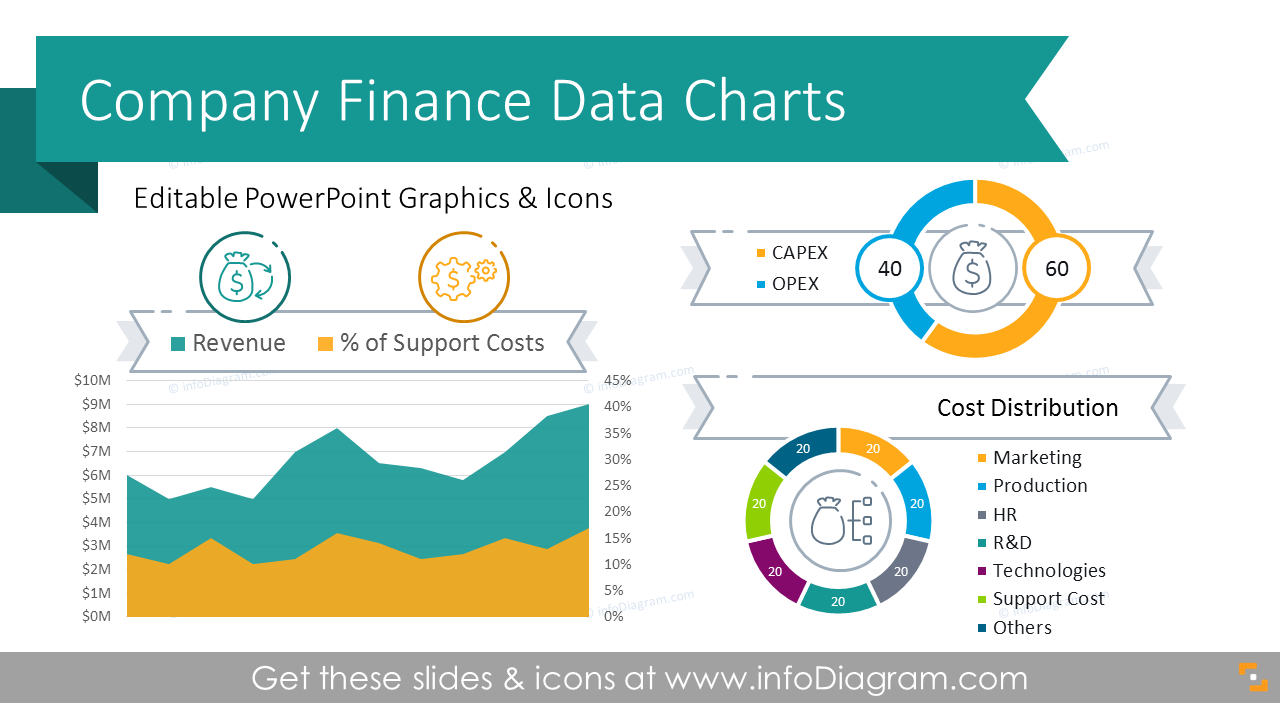

There are four sections to a company's financial statements: the balance sheet, the income statement, the cash flow statement, and the explanatory notes. What you'll learn. Financial statements offer a holistic picture of the value and profitability of your company to inform smart business decisions, help you. Learn about the four types of financial statements, including the balance sheet, income statement, cash flow statement, and statement of owner's equity. The income statement provides valuable insights into a company's financial performance and profitability during a specific period. It helps. Financial statements provide all the information needed to understand where your company stands in revenue, expenses, cash flow, runway, debt level and so. Below are five of the most essential accounting reports every business owner should be reviewing on a regular and annual basis. It starts with the revenue line and after deducting expenses derives net income. The cash flow statement look at the cash position of the company. It answers. Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company. There are four sections to a company's financial statements: the balance sheet, the income statement, the cash flow statement, and the explanatory notes. What you'll learn. Financial statements offer a holistic picture of the value and profitability of your company to inform smart business decisions, help you. Learn about the four types of financial statements, including the balance sheet, income statement, cash flow statement, and statement of owner's equity. The income statement provides valuable insights into a company's financial performance and profitability during a specific period. It helps. Financial statements provide all the information needed to understand where your company stands in revenue, expenses, cash flow, runway, debt level and so. Below are five of the most essential accounting reports every business owner should be reviewing on a regular and annual basis. It starts with the revenue line and after deducting expenses derives net income. The cash flow statement look at the cash position of the company. It answers. Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company.

As a small business owner, it's important to understand exactly what your financial statements (your income statement, balance sheet, and cash flow. A financial statement is a report that shows the financial activities and performance of a business. It is used by lenders and investors. 1.) The Big Three Financial Statements. 2.) Externally Prepared Financial Reports & Statements. 3.) Internally Generated Financial Information. 4.) The. Income Statement = Shows sales, expenses, and whether or not a profit was made. Balance Sheet = Show assets and liabilities, the amount invested in the business. In this article, you'll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them. The three essential financial statements to run your small business are your balance sheet, your income statement and your cash flow statement. Here, we'll. A look at the 4 key parts of a financial statement: the balance sheet & income statement are essential. Financial statements help you analyze a company's. 7 Financial Reports Business Owners Should Review Regularly · Financial Report #1: Income Statement · Financial Report #2: Balance Sheet · Financial Report #3. Financial Info · Overview · Financial Results · Income Statement · Balance Sheet · Cash Flow. Small Business Financial. Fundamentals Guide: Page 2. Financial Statements The Income Statement. The Income Statement is also called a Profit & Loss. In this section of your business plan, learn how to put your business finances into context to influence potential lenders or investors. Here we will examine financial data points that are key to formulation of a viable business strategy. What is a financial statement? A financial statements definition is, in the simplest sense, any document that helps show the financial state of your company. A financial statement is a valuable reporting tool for your small business. It helps you understand the financial health of your business so you can better. Clearly organized and reconstructed financial statements can maximize the value of your business in the eyes of potential buyers. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The income statement. Six most useful financial documents for small businesses: Income statement, Cash flow statement, Balance sheet, Accounts receivable aging report, Business plan. Financial statements are written records that convey the business activities and the financial performance of a company. They show the financial performance. To effectively evaluate the financial performance of the business requires financial information from three sources: a balance sheet, an income statement and a. To effectively evaluate the financial performance of the business requires financial information from three sources: a balance sheet, an income statement and a.

Bank Trust Account

Determine the rules of your trust. One of the benefits of a trust is that you can set parameters for how you want the funds or assets to be distributed. You. A trust is created to own your assets. Your checking account is one of those assets. A trust only works when all of the trust funding is completed. A trust is a fiduciary relationship in which one party (the Grantor) gives a second party (the Trustee) the right to hold title to property or assets for the. Need an Account? Bank on your time. Bank on your terms, when you find the TBT checking or savings account that is right for you and your financial needs. An account in trust is a type of financial account opened by one person for the benefit of another. To transfer your bank accounts to your trust, most banks prefer that you and your spouse come to a local branch of the bank and complete their trust. Explore Bank of America Private Bank's trust and estate planning services and receive guidance, resources, and strategies from our experienced team. After you select a product in our online application, make sure to indicate it's for a Trust before you move on to the next steps. Then, you'll need to provide. A Trust checking account uses funds from one or more financial sources. These can include good old-fashioned cash, savings, and insurance policies. And, just as. Determine the rules of your trust. One of the benefits of a trust is that you can set parameters for how you want the funds or assets to be distributed. You. A trust is created to own your assets. Your checking account is one of those assets. A trust only works when all of the trust funding is completed. A trust is a fiduciary relationship in which one party (the Grantor) gives a second party (the Trustee) the right to hold title to property or assets for the. Need an Account? Bank on your time. Bank on your terms, when you find the TBT checking or savings account that is right for you and your financial needs. An account in trust is a type of financial account opened by one person for the benefit of another. To transfer your bank accounts to your trust, most banks prefer that you and your spouse come to a local branch of the bank and complete their trust. Explore Bank of America Private Bank's trust and estate planning services and receive guidance, resources, and strategies from our experienced team. After you select a product in our online application, make sure to indicate it's for a Trust before you move on to the next steps. Then, you'll need to provide. A Trust checking account uses funds from one or more financial sources. These can include good old-fashioned cash, savings, and insurance policies. And, just as.

Trust accounts are operated by liberal professionals, such as lawyers and notaries. Here's how they can be used. A trust is an account in which the creator grants another party—the trustee—authority to hold assets that benefit a third party, known as the beneficiary. Wilson Bank & Trust has branches in Middle TN and proudly offers personal and commercial banking, checking accounts, loans and online banking. Explore now. With a Fidelity Trust Account, you make investments on behalf of a trust, putting the power of Fidelity's incomparable trading and research capabilities to. A trust is a legal contract between at least two parties: a grantor and one or more trustees. It can give you peace of mind that your family's wealth is managed. A trust is a fiduciary 1 relationship in which one party (the Grantor) gives a second party 2 (the Trustee) the right to hold title to property or assets. The best banks for trust accounts · Ally Bank · Charles Schwab Trust · Wells Fargo Private Bank · J.P. Morgan Private Bank · U.S. Bank. Ally Bank. Ally Bank is. When you create a trust, you make a legal arrangement that gives your trustee the power to hold the trust assets for the benefit or your beneficiaries. Does Capital One have Trust accounts? Yes! If you have an existing Capital One Bank account, you can convert it to Trust ownership. We currently offer this. A trust is a legal entity you create to hold certain assets in the care of a trustee for the benefit of the trustâ s beneficiaries. See how a Trust can help. A trust account is a legal arrangement through which funds or assets are held by a third party (the trustee) for the benefit of another party (the beneficiary). An account in trust, also known as a trust or ITF – “in trust for” – account, is a bank account that is registered by an individual but that is managed and. Protect and manage your trust account's assets with a Schwab One® Trust Account. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal. Fifth Third Bank helps you navigate complex financial needs such as wealth transfer, estate settlement, and trusts. Contact your bank. Each bank has requirements for transferring your bank accounts to a Trust. This process can be straightforward or more involved. It depends. Open or convert an account in the name of your personal trust. If you have an established revocable trust, open or convert your existing high-yield savings. Open an account. From checking and savings accounts, to money market and retirement accounts, Washington Trust offers a personal account to fit your needs. A DCU Savings or Checking Account - can be set up as a Trust Account. Only the Trustees may transact on the trust - The beneficiary has access to the funds. You can transfer cash and most assets into a revocable trust. Real estate, bank accounts, brokerage accounts and valuable personal property like jewelry. You can transfer cash and most assets into a revocable trust. Real estate, bank accounts, brokerage accounts and valuable personal property like jewelry.

How To Buy Stocks On Robinhood Step By Step

At Robinhood, you must already own shares of the underlying stock or ETF to sell a call. In options trading, short describes selling to open, or writing an. Keep in mind. The last-traded price won't necessarily be the execution price of your buy order. Our app will show you the equivalent Greenwich Mean Time. Investing · Investing with stocks: The basics · Extended-hours trading · Robinhood 24 Hour Market · Cancel or replace an order · Dividends · How to buy a stock. Robinhood forced the traditional stock market brokers to compete for customers – the days of $ per stock trade are gone. Then Robinhood did the next crazy. Investing · Investing with stocks: The basics · Extended-hours trading · Robinhood 24 Hour Market · Cancel or replace an order · Dividends · How to buy a stock. To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account. Placing an options trade. Robinhood empowers you to place options trades within your Robinhood account. Step 1: Download Robinhood · Step 2: Deposit money to invest · Step 3: Set goals and have a strategy · Step 4: Find stocks to invest in for the. Robinhood, 85 Willow Road, Menlo Park, CA © Robinhood. All rights reserved. What We Offer. Invest · Crypto. At Robinhood, you must already own shares of the underlying stock or ETF to sell a call. In options trading, short describes selling to open, or writing an. Keep in mind. The last-traded price won't necessarily be the execution price of your buy order. Our app will show you the equivalent Greenwich Mean Time. Investing · Investing with stocks: The basics · Extended-hours trading · Robinhood 24 Hour Market · Cancel or replace an order · Dividends · How to buy a stock. Robinhood forced the traditional stock market brokers to compete for customers – the days of $ per stock trade are gone. Then Robinhood did the next crazy. Investing · Investing with stocks: The basics · Extended-hours trading · Robinhood 24 Hour Market · Cancel or replace an order · Dividends · How to buy a stock. To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account. Placing an options trade. Robinhood empowers you to place options trades within your Robinhood account. Step 1: Download Robinhood · Step 2: Deposit money to invest · Step 3: Set goals and have a strategy · Step 4: Find stocks to invest in for the. Robinhood, 85 Willow Road, Menlo Park, CA © Robinhood. All rights reserved. What We Offer. Invest · Crypto.

Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. First Steps. The first thing you need to do if you are going to trade on your phone is download the Robinhood app. Go to the app store. Placing an options trade. Robinhood empowers you to place options trades within your Robinhood account. Step 1: · Step 2: Fund your Robinhood account: · Step 3: Log in to your Robinhood account. · Step 4: Enable option trading. · Step 5: Select options and complete. Step 1: · Step 2: Fund your Robinhood account: · Step 3: Log in to your Robinhood account. · Step 4: Enable option trading. · Step 5: Select options and complete. Robinhood, 85 Willow Road, Menlo Park, CA © Robinhood. All rights reserved. What We Offer. Invest · Crypto. Investors who want to buy Robinhood stock should follow a few steps before hitting the button. Before buying Robinhood stock—or any stock (see our guide on. To sell stocks on Robinhood, you will need a minimum of $ in your account before selling individual shares or your entire portfolio. Once. How do you cash out on Robinhood? Choose the stocks that you wish to sell. Click on "Sell" and enter how many shares you want to sell. Robinhood is an online stock brokerage that allows traders and investors to purchase stocks and ETFs without paying commissions. While that may be an advantage. I'm new to Robinhood and would love to learn some basics and just start to get into stocks in general but have no clue how to start what. Open an account. Cautiously buy one option. Make 30% in a week. Think you're a genius investor. Deposit your entire life savings. Invest all of it on. Step-by-Step Guide to Buying Stocks Pre Market on Robinhood · Create a Robinhood Account: If you don't already have a Robinhood account, you'll need to sign up. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? There is no additional cost of buying shares on Robinhood, other than the cost of the shares of stock. If the stock drops drastically, your. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? Before a stock is available to the general public, Robinhood lets you request the ability to purchase shares from investment banks at the IPO price. When. How to buy a stock. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. How to sell stocks at Robinhood · Log into the Robinhood app. · On the main page, scroll down to the stocks you own and select the stock you wish to sell. · You. The next step is to link your bank account or debit card to your Robinhood account. You'll need to do this to buy and sell stocks and to claim your Robinhood.

Google Alphabet A Stock

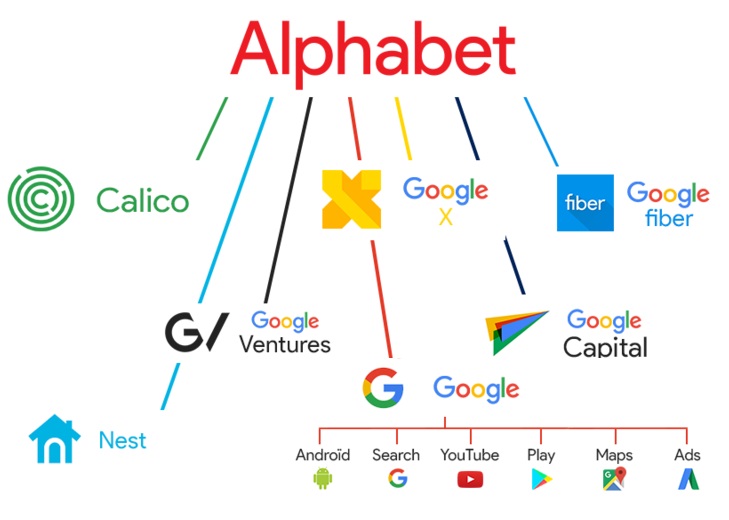

Get detailed information about the Alphabet Inc. stock (GOOGL) including Price, Charts, Technical Analysis, Historical data, Alphabet Reports and more. Alphabet price ; Market Cap. T ; Volume (3M). M ; Price-Earnings Ratio. ; Revenue. B. ; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range Get Alphabet Class A (GOOGL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Alphabet was originally founded as a search engine company in under the name Google Inc. Google went public through an initial public offering (IPO) in. Google Stock An AI Play For Health Care? The Doctor Will Hear You Now And Diagnose Your Cough. Technology giant and Google parent company Alphabet Inc. Discover real-time Alphabet Inc. Class A Common Stock (GOOGL) stock prices, quotes, historical data, news, and Insights for informed trading and investment. GOOG and GOOGL are stock ticker symbols for Alphabet (the company formerly known as Google). The main difference between the GOOG and GOOGL stock ticker. Find the latest Alphabet Inc. (GOOGL) stock quote, history, news and other vital information to help you with your stock trading and investing. Get detailed information about the Alphabet Inc. stock (GOOGL) including Price, Charts, Technical Analysis, Historical data, Alphabet Reports and more. Alphabet price ; Market Cap. T ; Volume (3M). M ; Price-Earnings Ratio. ; Revenue. B. ; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range Get Alphabet Class A (GOOGL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Alphabet was originally founded as a search engine company in under the name Google Inc. Google went public through an initial public offering (IPO) in. Google Stock An AI Play For Health Care? The Doctor Will Hear You Now And Diagnose Your Cough. Technology giant and Google parent company Alphabet Inc. Discover real-time Alphabet Inc. Class A Common Stock (GOOGL) stock prices, quotes, historical data, news, and Insights for informed trading and investment. GOOG and GOOGL are stock ticker symbols for Alphabet (the company formerly known as Google). The main difference between the GOOG and GOOGL stock ticker. Find the latest Alphabet Inc. (GOOGL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google. Discover real-time Alphabet Inc. Class C Capital Stock (GOOG) stock Google's other revenue is from sales of apps and content on Google Play and. GOOGL shares are included as a component on several stock market indices, namely S&P , S&P and NASDAQ The company operates through Google, its. Alphabet has a consensus price target of $ Q. What is the current price for Alphabet (GOOG)?. A. The stock price. Get the latest Alphabet Inc Class A (GOOGL) real-time quote, historical performance, charts, and other financial information to help you make more informed. Google is the leading internet search provider and uses its proprietary algorithms to offer targeted advertising. GOOG | Complete Alphabet Inc. Cl C stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stock analysis for Alphabet Inc (GOOGL:NASDAQ GS) including stock price, stock How Google is using AI to identify ocean sounds. updated Aug 26, Alphabet Inc. Cl A · AT CLOSE PM EDT 08/29/24 · USD · % · Volume19,, Alphabet Class A stock analysis. $ Close: $(%). Stock Google's other revenue is from sales of apps and content on Google Play and. Alphabet Inc. Cl A ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The current price of GOOG is USD — it has increased by % in the past 24 hours. Watch Alphabet Inc (Google) Class C stock price performance more. Stock analysis for Alphabet Inc (GOOG:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Alphabet Cl A (GOOGL) Are These Magnificent Seven Stocks A Buy Now? Alphabet | Amazon | Apple | Meta | Microsoft | Nvidia | Tesla · Google Stock: Alphabet. The company is gaining market share in the cloud-computing, driven by continued strength in Google Cloud Platform and Google Workspace. Alphabet also enjoys. Alphabet Share Price Live Today:Get the Live stock price of GOOG Inc., and Google Maps, Google Photos, Google Play, Search, and YouTube. Its Google. Alphabet, Inc. is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google. Alphabet is a holding company. Internet media giant Google is a wholly owned subsidiary. Google services account for nearly 90% of Alphabet's revenue. The sneaky way Big Tech is acquiring AI unicorns without buying the companies 18 Hours Ago fly-project-la-musica.ru · How Big Tech is quietly acquiring AI startups · Google Cloud.

Best Health Insurance Companies For Self Employed

:max_bytes(150000):strip_icc()/GettyImages-1345513639-2d4aa62bb229414ba07628fbd4375de4.jpg)

We have more than 15 quality health plans designed specifically for the Sole Proprietor, employee and independent contractors. One bit of good news health insurance premiums are generally % deductible to self-employed people who have a positive income. Here's the bottom line. Cost. Explore Anthem individual and family plans for self-employed workers and find coverage that works for your unique healthcare needs and budget. The association accepts self-employed individuals and sole proprietors who are residents of NY, NJ and CT. When you join this association, you will have access. If you're self-employed or don't have coverage through an employer, purchasing an individual health plan is your best option. These plans cover one member. You can apply for individual and family health insurance coverage through MNsure if you are a freelancer, consultant, independent contractor. With a large network of providers and easy tools and resources, those who are self-employed can quickly find a health insurance plan that works for them. You can usually join your local chamber of commerce and purchase into their group insurance plan. They should have a couple of options, unless. We have helped thousands of small businesses, self-employed people, Medicare eligible seniors and individuals with their health insurance needs. We have more than 15 quality health plans designed specifically for the Sole Proprietor, employee and independent contractors. One bit of good news health insurance premiums are generally % deductible to self-employed people who have a positive income. Here's the bottom line. Cost. Explore Anthem individual and family plans for self-employed workers and find coverage that works for your unique healthcare needs and budget. The association accepts self-employed individuals and sole proprietors who are residents of NY, NJ and CT. When you join this association, you will have access. If you're self-employed or don't have coverage through an employer, purchasing an individual health plan is your best option. These plans cover one member. You can apply for individual and family health insurance coverage through MNsure if you are a freelancer, consultant, independent contractor. With a large network of providers and easy tools and resources, those who are self-employed can quickly find a health insurance plan that works for them. You can usually join your local chamber of commerce and purchase into their group insurance plan. They should have a couple of options, unless. We have helped thousands of small businesses, self-employed people, Medicare eligible seniors and individuals with their health insurance needs.

State or federal marketplace · Medicaid · Medicare · Employer plan through a family member · Private insurance · Association health plans · Health sharing plans. Kaiser Permanente: Best health insurance. Blue Cross Blue Shield: Best health insurance for the self-employed. UnitedHealthcare: Best health insurance. Join the NASE Now and gain expert advice on starting a business, self-employed health insurance, and access to small business health insurance quotes. MN Health Insurance Network works with MN's top insurance carriers in order to match you with the best self-employed insurance plan. Official Site of Anthem Blue Cross, a trusted health insurance plan provider. Shop plans for Medicare, Medical, Dental, Vision and Employers. Before calling insurance companies and looking for quotes it's a good idea to first assess your needs. Some basic questions you might want to ask yourself are. There is no employer to offer a group health insurance benefit or share in the cost of premium expenses. Self-employed individuals are solely responsible for. Administrative services are provided by United HealthCare Services, Inc. Products and services offered are underwritten by Golden Rule Insurance Company, Oxford. Top Options to Get Self-Employed Insurance for Freelancers · 1. Spouse's Policy · 2. COBRA · 3. Affordable Care Act · 4. Local chamber or business group · 5. company attract and retain the best employees. Please note that 2 person group's must have one W2 employee who is not a spouse. If you do not currently meet. Shop and compare new york health insurance companies in all 62 counties. Vista Health Solutions represents every major carrier in New York State. Generally, if you run your own business and have no employees, or are self-employed, your business won't qualify for group coverage. What are the best health insurance options for self-employed individuals? · ACA exchange · Short-term health insurance policies · Medicaid · COBRA coverage. You can also get insurance coverage for yourself and your family through the Affordable Care Act (ACA), sometimes called “Obamacare.” The ACA created the Health. Do any of you have suggestions for Health Insurance for self employed Best cheaper life insurance companies for senior 63 yo woman no medical. Self-employed workers can get private health insurance or federal marketplace coverage, also known as the Affordable Care Act (ACA) or Obamacare health. A health plan through Covered California is a great option for people who work for themselves. Freelancers, independent contractors and other people who don't. What are the best health insurance options if you're self-employed? · COBRA Health Insurance · Spouse's Group Plan · Ex-employer's Plan · Set Up a Small Business. health insurance. You can enroll through Connect for Health Colorado if you're a freelancer, consultant, independent contractor, or other self-employed worker. 1. United Healthcare United Healthcare is one of the best-known healthcare providers in the country. Founded in , they became the nation's biggest health.

Solar System Purchase Price

Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. In New York, the average cost of a solar panel system ranges from around $30, to $50, before tax credits. The cost-per-watt in New York averages around. Range of price is anywhere from $3-$5/W, depending on where you live and the details of your system. So, $12, - $20, That's before any. On average, businesses can anticipate an initial investment ranging from $, to $,+ for their solar system, taking into account the system size and. The average cost of a kW solar panel installation on EnergySage is $20, after federal tax credits. You'll probably save anywhere. However, these benefits typically come with significant installation and maintenance costs, and the magnitude of the gains can vary widely from one house to. Solar panels are a serious investment in your home and the environment. Learn more about solar panel costs and available offsets with this detailed guide. Solar panels for a 1, square foot house cost roughly $18,, with average pricing in the United States ranging between $8, and $25, According to. The cost of a solar system installation can vary widely when you compare the efficiency rate of the solar panels and other installation expenses. The best solar. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. In New York, the average cost of a solar panel system ranges from around $30, to $50, before tax credits. The cost-per-watt in New York averages around. Range of price is anywhere from $3-$5/W, depending on where you live and the details of your system. So, $12, - $20, That's before any. On average, businesses can anticipate an initial investment ranging from $, to $,+ for their solar system, taking into account the system size and. The average cost of a kW solar panel installation on EnergySage is $20, after federal tax credits. You'll probably save anywhere. However, these benefits typically come with significant installation and maintenance costs, and the magnitude of the gains can vary widely from one house to. Solar panels are a serious investment in your home and the environment. Learn more about solar panel costs and available offsets with this detailed guide. Solar panels for a 1, square foot house cost roughly $18,, with average pricing in the United States ranging between $8, and $25, According to. The cost of a solar system installation can vary widely when you compare the efficiency rate of the solar panels and other installation expenses. The best solar.

If you are going through an installer, you're looking at around $ per panel ( watts x cents). If you're going DIY and buying panels yourself, you'. Total turnkey costs for purchasing and installing a 4kW system range from $12, for affordable components to $16, for premium components. The cost is about. Solar panels ; Panasonic w EverVolt HK Module, Black/Black · $ ; Silfab Solar w Prime HC+ Module · This product has been. However, these benefits typically come with significant installation and maintenance costs, and the magnitude of the gains can vary widely from one house to. How much does one solar panel cost? The average cost for one W solar panel is between $ and $ when it's installed as part of a rooftop solar array. On average, homeowners can expect to pay between $20, to $40, for a ground-mounted solar panel system before incentives. Businesses can expect to pay $ You'll pay anywhere from $ to $ per watt to purchase a solar panel. With labor and other factors, solar panel installation costs a total of $ to. The first thing I found was this: “According to our solar experts, solar panels cost about $ to install in the United States. How Much Do Solar Panels Cost in California? The average cost of solar panels in California is around $19, If you take the full federal solar tax credit. $11, Current price is: $11, System Highlights: Solar Power Size: Watts Battery Capacity: kWh. Solar power systems are very custom based on the home, roof type, shading, and utility. Installation of panels for the average 5kW system ranges from. On average, our customers pay $ per month when financing an kilowatt residential solar system. Other customers pay as little as $99 per month. Every home. Solar system prices vary, depending on the type of solar panels, manufacturer, cell size and wattage output. Our solar panels cost between $ to $ per. Approximately $ per house and million houses. That's about $ billion. The average size of a residential solar system is between 5 kW ($60/mo. electric bill) and 10 kW ($/mo. electric bill). Solar panels for a home will cost. Installing solar panels costs an average of $27,, though it ranges between $3, and $55, based on system size, panel type, wattage, and more. Solar Installed System Cost Analysis. NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial. As of Aug , the average cost of solar panels in Jamaica is $ per watt making a typical watt (6 kW) solar system $ before the federal solar. Solar Panel Installation Stat. According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated.

Best Car Insurance In Iowa

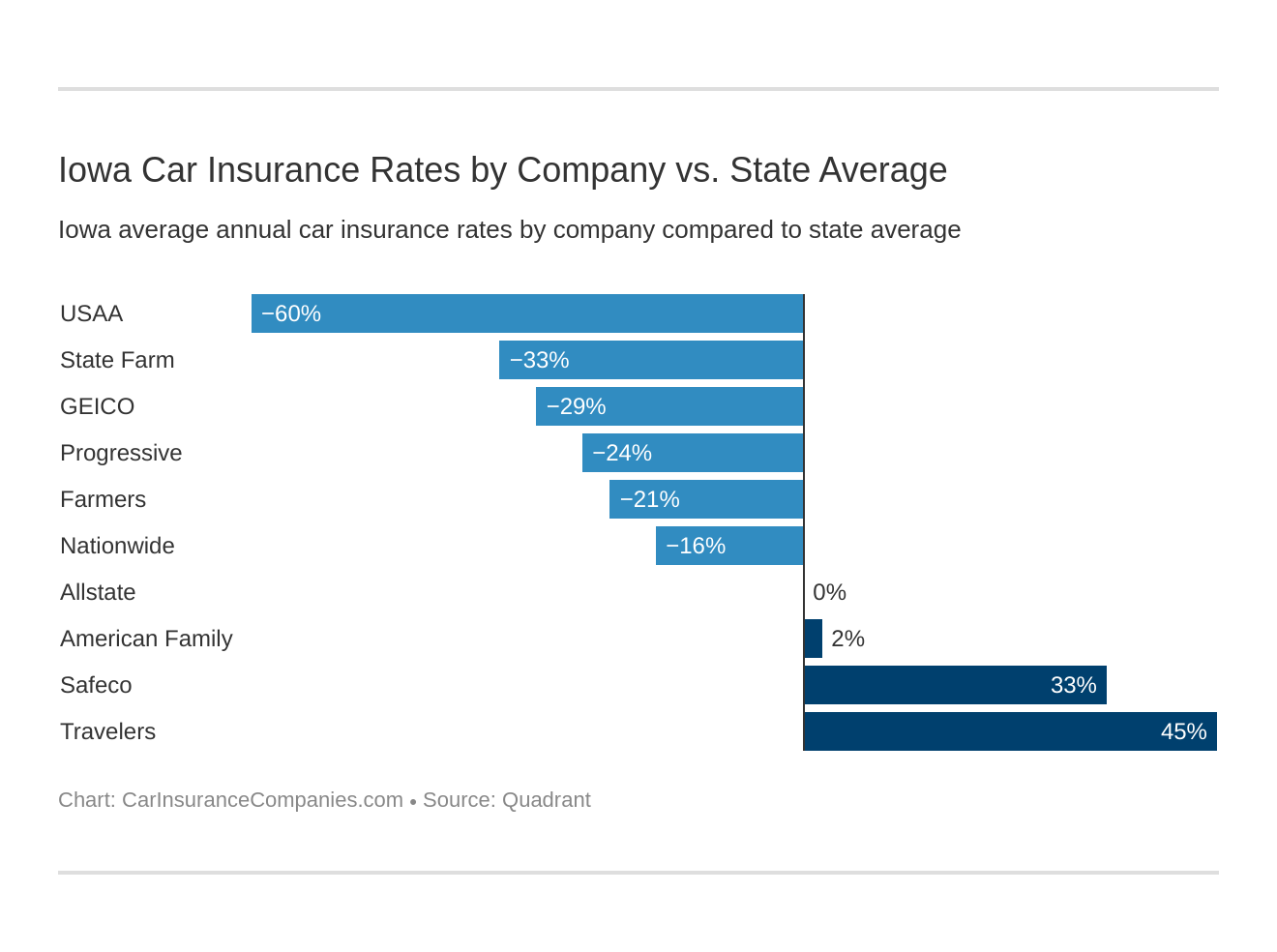

The best car insurance companies in Iowa ; 1st place medal. USAA ; 2nd place medal. Shelter Insurance ; 3rd place medal. Farmers. Feel secure knowing you have an insurance provider you can rely on. With Nationwide, it's easy to customize your policy with affordable options for Iowa auto. Need car insurance in Iowa? We'll help you find the right IA auto coverage and discounts to help you save. Get a free online quote in less than 10 minutes. Get the right automobile insurance for your safety and your property. Coverage Amounts. Iowa law requires minimum liability coverage. Based on Bankrate's research, Geico, State Farm, Progressive, Auto-Owners and Nationwide write the best car insurance policies in Iowa. Root offers fair auto insurance to good drivers in Iowa. From Des Moines to Sioux City, safe drivers could save hundreds on car insurance. Get a free quote. The best car insurance companies in Iowa are Town & Country Insurance, The General, and Direct Auto, based on user ratings on WalletHub. Drivers in Iowa can. You could save 15% or more on Iowa auto insurance with a fast, free online quote from GEICO! Learn the minimum required coverage for drivers in the Hawkeye. Car insurance is ridiculously cheap here. /month means you will save money here. Progressive has been the cheapest for me thus far. The best car insurance companies in Iowa ; 1st place medal. USAA ; 2nd place medal. Shelter Insurance ; 3rd place medal. Farmers. Feel secure knowing you have an insurance provider you can rely on. With Nationwide, it's easy to customize your policy with affordable options for Iowa auto. Need car insurance in Iowa? We'll help you find the right IA auto coverage and discounts to help you save. Get a free online quote in less than 10 minutes. Get the right automobile insurance for your safety and your property. Coverage Amounts. Iowa law requires minimum liability coverage. Based on Bankrate's research, Geico, State Farm, Progressive, Auto-Owners and Nationwide write the best car insurance policies in Iowa. Root offers fair auto insurance to good drivers in Iowa. From Des Moines to Sioux City, safe drivers could save hundreds on car insurance. Get a free quote. The best car insurance companies in Iowa are Town & Country Insurance, The General, and Direct Auto, based on user ratings on WalletHub. Drivers in Iowa can. You could save 15% or more on Iowa auto insurance with a fast, free online quote from GEICO! Learn the minimum required coverage for drivers in the Hawkeye. Car insurance is ridiculously cheap here. /month means you will save money here. Progressive has been the cheapest for me thus far.

Drivers with a clean driving record for the last three to five years have the greatest chance of saving on car insurance. In this case, insurers have classified. The best car insurance for high-risk drivers in Iowa is Farm Bureau and Grinnell Mutual. The Zebra advises how Iowans can get cheap car insurance after. Bristol West helped a Ford Fusion driver in Burlington, Iowa save on car insurance with this quote. A Burlington, Iowa driver just saved on coverage for their. Waterloo, IA Best Car Insurance Companies ; 1, State Farm, $ ; 2, Nationwide ThreeSixZero, $ ; 3, IMT Insurance Company, $ ; 4, Hastings Mutual. Travelers and West Bend Mutual have the overall cheapest car insurance in Iowa for good drivers, based on the companies in our analysis. The Cheapest Car. According to our rate analysis, the cheapest car insurance company in Iowa is State Farm, with an average rate of $ per year. AAA is ranked #1 in customer satisfaction for Digital Insurance Shopping Experience by J.D. Power. Try our digital shopping experience yourself. What is the best car insurance in Iowa? · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save with. In the end, the coverage you choose will depend on the vehicle you want to insure, and your budget. State Farm delivers options, from start to finish. We insure. New Allstate auto insurance in Iowa, with all-new ways to save · Drivewise icon. Save more than ever with a new Drivewise®. Connect your driving data to save up. The best homeowners insurance company in Iowa is Amica with a score of out of 5, according to our research. Insurify identified Auto-Owners, USAA, and GEICO as some of the best insurance companies in Iowa. These companies offer drivers plenty of discounts, coverage. The best high-risk auto insurance companies in Iowa are State Farm, USAA, and Geico because they offer the most competitive rates for high-risk drivers. You. Farmers: Best for Insurance Discounts · Travelers: Best for Comprehensive Coverage · American Family: Best for Discount Availability · Liberty Mutual: Best for. Iowa drivers pay an average of $1, per year for full coverage car insurance and $ per year for minimum coverage. Find quotes for your area. What is the best car insurance in Iowa? · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save with. Top 21 auto insurance companies in Iowa · 1. McKay Insurance Agency, Inc. · 2. RJR Insurance · 3. Farm Bureau Financial Services · 4. Central Financial Group · 5. On average, Ames drivers pay a premium of around $23 every month for state-required minimum liability auto insurance. That's $4 more than the Iowa state average. Based on our research, we found Pekin to be the best provider for most drivers in Iowa. Here are our ratings for the options we recommend. Overall Rating, Cost. Compare 50+ top insurance companies including Progressive, Travelers, AAA, Nationwide (and more!) to find the best and cheapest car insurance in Iowa.

Appraisal Cost For Refinance

Appraisal fees are included in the closing costs a borrower pays. According to the “ Appraisal Survey” of appraisers by the National Association of Realtors. Lenders also consider the appraised value of the home when refinancing. Differences between mortgage refinancing and renewal. Mortgage renewal and mortgage. Appraisal fee · Conventional loans usually cost somewhere between $$ · FHA almost always costs at the higher end of this spread at $ · VA loans run up to. There may also be associated fees for mortgage registration and property valuation. But if you're able to take advantage of lower interest rates, your. While your lender will hire the appraiser, you, the borrower who is refinancing a home, are responsible for the cost. The fees generally range between $ and. Title Insurance Premium – this is for a lender's title policy. Rates are based on loan amount. Usually between $ $ Notary Fee – between $ and $ Appraisers generally charge $ to $ Title insurance fee: You'll need to purchase a new title insurance policy when you refinance in case there are errors. Your Loan Estimate and Closing Disclosure will show the cost of the appraisal (if one is required) and depending on which combination of rate and closing costs. Refinancing costs include your loan origination fee and the following: Government recording costs. Appraisal fees. Credit report fees. Lender origination fees. Appraisal fees are included in the closing costs a borrower pays. According to the “ Appraisal Survey” of appraisers by the National Association of Realtors. Lenders also consider the appraised value of the home when refinancing. Differences between mortgage refinancing and renewal. Mortgage renewal and mortgage. Appraisal fee · Conventional loans usually cost somewhere between $$ · FHA almost always costs at the higher end of this spread at $ · VA loans run up to. There may also be associated fees for mortgage registration and property valuation. But if you're able to take advantage of lower interest rates, your. While your lender will hire the appraiser, you, the borrower who is refinancing a home, are responsible for the cost. The fees generally range between $ and. Title Insurance Premium – this is for a lender's title policy. Rates are based on loan amount. Usually between $ $ Notary Fee – between $ and $ Appraisers generally charge $ to $ Title insurance fee: You'll need to purchase a new title insurance policy when you refinance in case there are errors. Your Loan Estimate and Closing Disclosure will show the cost of the appraisal (if one is required) and depending on which combination of rate and closing costs. Refinancing costs include your loan origination fee and the following: Government recording costs. Appraisal fees. Credit report fees. Lender origination fees.

Appraisal fees are included in the closing costs a borrower pays. According to the “ Appraisal Survey” of appraisers by the National Association of Realtors. The experience and reputation of the appraiser can also impact the cost of the appraisal. Appraisers with extensive experience and a strong reputation in the. The experience and reputation of the appraiser can also impact the cost of the appraisal. Appraisers with extensive experience and a strong reputation in the. The home appraisal comes typically from the mortgage lender, but the cost is covered by the home-buyer. While the cost of home appraisals can vary, it. Common mortgage refinance fees ; Home appraisal, $ to $ ; Home inspection, $ to $ ; Flood certification fee, $15 to $25 ; Title search and insurance fee. Home Inspection Fees: $ to $ Optional costs but strongly recommended to have it done. · Appraisal Fees: $ to $ some lenders would prefer to appraise. Refinancing costs include your loan origination fee and the following: Government recording costs. Appraisal fees. Credit report fees. Lender origination fees. Buyers are typically responsible for the cost because lenders require an appraisal to approve a mortgage. What's the Difference Between a Home Appraisal and a. A home appraisal is an unbiased professional opinion of a home's value. Appraisals are often used in purchase-and-sale transactions and commonly in refinance. An appraisal is a process of determining the value of the home by a professional who is unbiased and impartial in their judgment. Appraisals are used in. A rule of thumb is two percentage points. Also watch out for closing fees included in the refinanced mortgage. Hence the no closing costs paid. Title Insurance Premium – this is for a lender's title policy. Rates are based on loan amount. Usually between $ $ Notary Fee – between $ and $ Determine how much it will cost you to refinance your mortgage. View this content Loan Info. Appraised value? Must be between $1 and $1,,, Your Loan Estimate and Closing Disclosure will show the cost of the appraisal (if one is required) and depending on which combination of rate and closing costs. While your lender will hire the appraiser, you, the borrower who is refinancing a home, are responsible for the cost. The fees generally range between $ and. Mortgage lenders use appraisals to ensure they don't lend more than the home's worth, using the appraised value and loan-to-value ratios to determine lending. With costs starting between $ to $1, CAD, it's a significant investment that can greatly influence buying, selling, and refinancing. The Police Credit Union will need to determine the value of your property prior to completing a refinance. The fees will generally vary but range anywhere. Move the sliders or type in a specific number to estimate your monthly payment. Loan Info. Appraised value. An appraisal is an unbiased estimate of the value of a home that is conducted by a third party appraiser. Lenders order them to ensure that the home is worth.

2 Daily Return On Investment

Free return on investment (ROI) calculator that returns total ROI rate and annualized ROI using either actual dates of investment or simply investment. returns (FIGURE 1 and FIGURE 2). Along with using the Rule of investment-doubling time periods resulting from a series of hypothetical rates of return. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio. 2 | SAVING AND INVESTING. Page 3. A ROADMAP TO YOUR JOURNEY TO FINANCIAL To maximize your fund returns, or any investment returns, know the effect. Yields can change on a daily basis, and the amount of income can vary significantly with changing interest rates. Higher rates of return often involve a higher. Prior () Return Breakpoints TXT CSV Details · Click here for 6 Developed Portfolios Formed on Size and Investment (2 x 3) [Daily] TXT CSV Details. Our handy calculator works on a monthly compounding period, and calculates your total returns based on your return rate period and timeframe in years. How About 2% Daily Returns and Utility? Daily ROI investors It may not be the right investment for you, and that's ok. There are. You can calculate the return on your investment by subtracting the initial amount of money that you put in from the final value of your financial investment. Free return on investment (ROI) calculator that returns total ROI rate and annualized ROI using either actual dates of investment or simply investment. returns (FIGURE 1 and FIGURE 2). Along with using the Rule of investment-doubling time periods resulting from a series of hypothetical rates of return. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio. 2 | SAVING AND INVESTING. Page 3. A ROADMAP TO YOUR JOURNEY TO FINANCIAL To maximize your fund returns, or any investment returns, know the effect. Yields can change on a daily basis, and the amount of income can vary significantly with changing interest rates. Higher rates of return often involve a higher. Prior () Return Breakpoints TXT CSV Details · Click here for 6 Developed Portfolios Formed on Size and Investment (2 x 3) [Daily] TXT CSV Details. Our handy calculator works on a monthly compounding period, and calculates your total returns based on your return rate period and timeframe in years. How About 2% Daily Returns and Utility? Daily ROI investors It may not be the right investment for you, and that's ok. There are. You can calculate the return on your investment by subtracting the initial amount of money that you put in from the final value of your financial investment.

Basically, it tells you how much a stock's value changed over a day. Using this information, you can determine whether you want to invest more in a company or. This investment returns calculator can help you estimate annual gains. Learn if you're on track to meet your long-term goals. Inflation returns sustainably to the 2% target in the second half of Daily Digest · Exchange rates · Interest rates · Price indexes · Indicators. return compounded annually for two years, your investment would be worth $11, In reality, investment returns will vary year to year and even day to day. fly-project-la-musica.ru provides a FREE return on investment calculator and other ROI calculators to compare the impact of taxes on your investments. This investment's ROI is 2 multiplied by , or %. Here's another example: An investor puts $10, into a venture with no fees or associated costs. The. Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount. Date, Reason, Factor, Shares, Price, Value, %. January 2, , Initial Investment, 1,, $, $50,, 0%. February 12, , Dividend, reward in comparing two different investments with different rates of return; Retirement planning and working out what sort of nest egg you might have; Looking. Use this free investment calculator to calculate how much your money may grow and return over time when invested. In observance of the Labor Day federal holiday, the New York Stock Exchange and Capital Group's U.S. offices will be closed on September 2, close. Investing > How To Invest > Stocks > Good Return On Investment. What Is a In two of the past 11 years, the S&P had a negative return. In The tables show the returns of each Investment Portfolio over the time period(s) by comparing the average annual total return of an Investment Portfolio. Converting daily returns to annual returns simplifies with a basic equation, AR = ((DR + 1)^ – 1) x The same formula applies to various return. Rate of return on investment: X. Rate of return on investment: This is the compound daily, compound monthly, compound quarterly, compound semi-annually. Investment Calculator. Investment Month. January, February, March, April, May, June, July, August, September, October, November, December. Investment Day. 1, 2. The other investor was not so lucky and actually picked the worst day (market high) each year. Even with the worst investment timing, the average annual return. August; September; October; November; December. Investment Day. 1, 2, 3, 4, 5, 6, 7, 8, 9 Return calculations do not include reinvested cash dividends. Data. For example, if you had $50, to invest, then a fund with a day yield of 2% could potentially give you $1, a year in income payments. Keep in mind.

Venture Capital Investopedia

What Is Venture Capital? Venture capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. The calculation behind the catch-up provision that determines the general partner's (GP) carried interest at a private equity fund. So you want to be a venture capitalist? Learn what it takes, where to start, and what kind of attitude you will need to take on the world of venture. Investopedia. Best for Earning a High Interest Rate. Data as of 8/23/ From active and passive equities to alternatives like venture capital, you. Access 50+ services that remove friction from fund management for venture funds, rolling funds, and syndicates. Equity Management. Equity Management. VC funds' goal is to increase the startup's value and eventually profitably exit the investment. Although it's a common way, venture capital does not always. Venture Capitalist: A private equity investor that provides capital to companies with high growth potential. Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to. Key Takeaways · Venture capital firms provide funding to startup companies and small businesses—namely, those with fewer options for raising money. · Venture. What Is Venture Capital? Venture capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. The calculation behind the catch-up provision that determines the general partner's (GP) carried interest at a private equity fund. So you want to be a venture capitalist? Learn what it takes, where to start, and what kind of attitude you will need to take on the world of venture. Investopedia. Best for Earning a High Interest Rate. Data as of 8/23/ From active and passive equities to alternatives like venture capital, you. Access 50+ services that remove friction from fund management for venture funds, rolling funds, and syndicates. Equity Management. Equity Management. VC funds' goal is to increase the startup's value and eventually profitably exit the investment. Although it's a common way, venture capital does not always. Venture Capitalist: A private equity investor that provides capital to companies with high growth potential. Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to. Key Takeaways · Venture capital firms provide funding to startup companies and small businesses—namely, those with fewer options for raising money. · Venture.

Venture capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. These fundraising rounds allow investors to invest money into a growing company in exchange for equity/ownership. The initial investment—also known as seed. Capital investment is the expenditure of money to fund a company's long-term growth. · The term often refers to a company's acquisition of permanent fixed assets. Venture Debt · Lending to Complex Structures · View All. Capital Markets An example headwind might be increased capital requirements for financial. A venture capitalist (VC) is an investor who provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake. Teachers, Professors & Investment Clubs. Here are some useful resources to help you get started on setting up your class or contest. COLLEGE PROFESSORS: Learn. Investment Options, Customer Service, Education, Ease of Use, and Overall. Investopedia, February Fidelity was named Best Overall online broker, Best. Venture capitalists make their returns through the ownership of large numbers of company shares. Private equity firms typically provide venture capital. logo-investopedia-btmgrey Best Robo Advisor for Beginners ; BuySide. Best Overall Robo Advisor ; Forbes Advisor Logo. Best Robo Advisor Investment. A venture capitalist (VC) is an investor who provides capital to new businesses, typically startups with high growth potential, in exchange for an equity stake. A venture capital-backed IPO refers to selling to the public shares in a company that has previously been funded primarily by private investors. Venture capital funding provides capital to grow a business. However, entrepreneurs will also lose some control over business decisions. A venture capitalist (VC) is an investor who provides capital to new businesses, typically startups with high growth potential. Venture capitalists provide the lion's share of the money needed to start a new business. It is a considerable investment, paying for product development. Investopedia. @investopedia. K subscribers• videos. Official Youtube Investopedia Video: Intro To Mutual Funds. Investopedia. K views. 11 years. Startup capital is money invested to launch a new business. Venture capitalists provide funding in return for an ownership share in the business. Capital Investment Definition - Investopedia - Free download as PDF File .pdf), Text File .txt) or read online for free. Capital investment is a sum of. Most mutual funds set a relatively low dollar amount for initial investment and subsequent purchases. Liquidity. Mutual fund investors can easily redeem their. These fundraising rounds allow investors to invest money into a growing company in exchange for equity/ownership. The initial investment—also known as seed. Carried interest is a share of profits from a private equity, venture capital or hedge fund earned by the fund's general partner.